Theoretical Motivation:

During the final stages of the Manhattan Project, Stanislaw Ulam and John Von Neumann developed the Monte Carlo method in order to calculate on average how long it would take for a neutron to collide with the nucleus of an atom when projected into a given substance. Named after the famous Monaco casino, Monte Carlo methods are often used to describe systems that have a set range of inputs and parameters, the specifics of which are unknown. The method inputs random or pseudo-random values into the system over and over again to see if a certain trend emerges when certain combinations of values are chosen. Often, Monte Carlo methods are used to simulate systems in physics that have many coupled degrees of freedom, such as radiation and fluid dynamics. However, many social scientists have since begun to use Monte Carlo simulations to predict the ways that certain trends develop, particularly in the world of finance and economics.

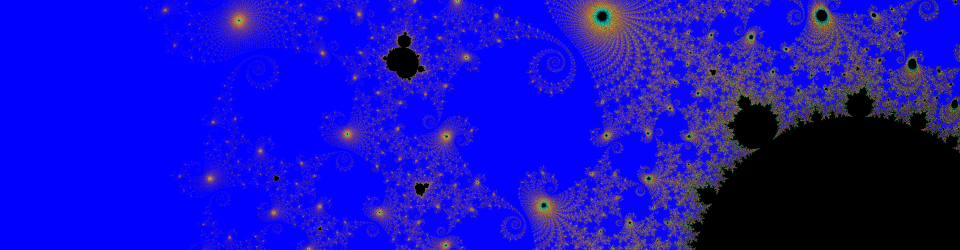

The Ising model emerged from the study of ferromagnetism, providing a way to study the interactions between adjacent atoms with discrete magnetic spin numbers. Since each spin influences its surrounding neighbors, these systems are modeled by creating a grid of cells that influence the cells around it based on a specific set of laws or equations. In the context of physics, the Ising model has since expanded from the field of ferromagnetism into thermodynamic phase transitions and other related fields. Like the Monte Carlo method, it has also been commandeered by the finance community to map the progress of interrelated variables and actors in an economic system. It does so by defining a set of actors governed by mutual economic and financial laws.

Finally, in the world of finance, volatility refers to the way that a financial instrument’s price changes over time. Many traditional models of volatility follow a deterministic approach in which the price of a financial security (any type of financial asset) has a constant volatility over time. However, these models often fail because the volatility of any given security is in reality stochastic over time and evolves due to the contributions of many factors, some of which cannot be seen directly. To account for this stochastic volatility when determining the price of financial assets, economists have often turned to Monte Carlo methods and the Ising model to predict the way interrelated, seemingly random factors evolve over time. Adam Warner and I plan to gain a preliminary understanding of the way that these methods transfer from physics to the world of finance.

Description:

I will begin my study by using MatLab to write very basic examples of both an Ising system and an independent Monte Carlo method, starting with the discussion in Giordano’s computational physics. I will then use a Monte Carlo simulation to solve a more rigorous physics problem, concerning the emission of radiation from an atom. This process is stochastic in nature, so I believe it will be a good precursor to looking at the kind of method necessary to solve a financial volatility problem. I will then attempt to model the volatility of a derivative security, a financial asset that depends on the prices of other more basic assets. Finally, if time allows, Adam and I will work together to develop an Ising model that describes an economic system.

Timeline:

Week 1 (4/6-4/12)

I will finish my research on the basic principles of the Ising Model, Monte Carlo Methods, and Volatility. I would like to have a comprehensive list of papers to reference and be ready to start working in MatLab.

Week 2 (4/13-4/19)

At this point, I will start to work on my models for the basic Monte Carlo and Ising problems. I do not think that these will be too rigorous and I hope to be able to display these in my first preliminary results report. I will need to figure out the kind of notation to use for this sort of computation.

Week 3 (4/20-4/26)

By then, I should be ready to start my model of atomic radiation. This will help me get a good grasp on how to approach a stochastic system in MatLab and should be an example of some pretty interesting physics concepts. I hope to get this into my preliminary results as well, but am less certain.

Week 4 (4/27-5/3)

Now, I will attack the meat of my project. I will use all of the concepts I have worked with up to this point to model the stochastic evolution of the volatility of derivative security.

Week 5 (5/4-5/10)

This week I should be able to finish the model described previously. If all goes according to plan, I will have time to work with Adam on characterizing how an Ising model would be able to describe the evolution of interconnected securities and the decisions made to give them prices.

Sources:

1. Computational Physics, Giordano and Nakanishi

2. Physics and Financial Economics (1776-2014): Puzzles, Ising and Agent-Based models

D. Sornette (ETH Zurich)

3. University of Virginia: Introduction to Atomic Simulations, Leonid Zhigilei

4. Probability Review and Overview of Monte Carlo, Martin Haugh

5. Monte Carlo Methods for Security Pricing, Phelim Boyle, Mark Boardie, Paul Glasserman

6. Monte Carlo simulation of the atomic master equation for spontaneous emission

R. Dum, P. Zoller, and H. Ritsch