This summer I have been working with Professor Evsen Turkay on the project that studies the relationship between a firm’s competitiveness and the level of integration between the upstream firm and downstream firm. We define the level of integration by evaluating how closely up and downstream firms are interrelated. The more interrelated the firms are, the higher level of vertical integration. Our hypothesis has been that, because higher level of vertical integration implies more information exchanges between the upstream and downstream firm, the better chance it will be for the upstream firms to avoid uncertainty and risk in research and development because they have better information about what products are being demanded at the moment. As a result, they tend to be more competitive and will take up more market share than other firms.

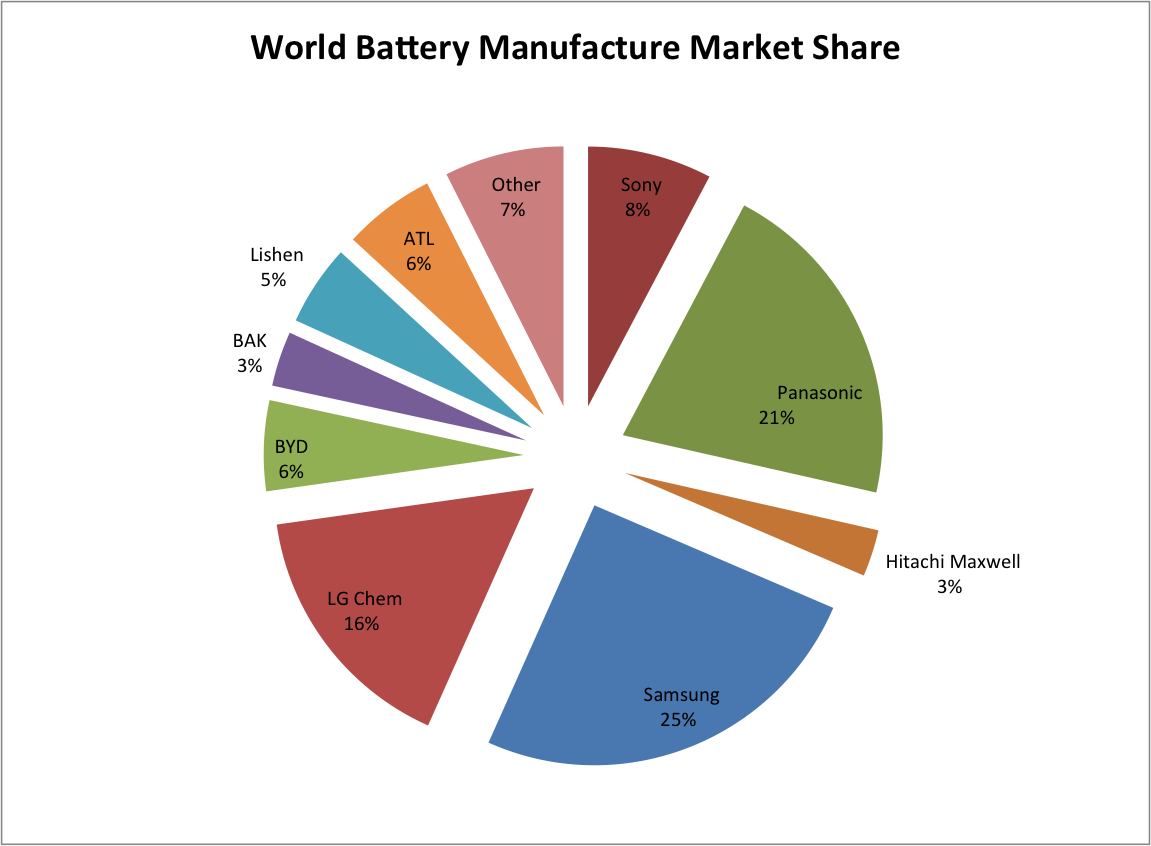

We started our research by getting the market information of lithium-ion battery industry (upstream firms) in which we discovered that: 1. Although U.S. has been the top-notch developer of technology in this area, Asian firms took the largest market share. 2. Asian firms seem to be more vertically integrated than the U.S. firms. 3. Other kind of advantages of Asian firms, such low labor costs, do not take a huge share in entire cost of production. 4. Other costs in production, such as material costs, are not basically the same for firms all over the world. All the information allows us to make the corollary that level of vertical integration decides the outcome of such unbalanced market share.

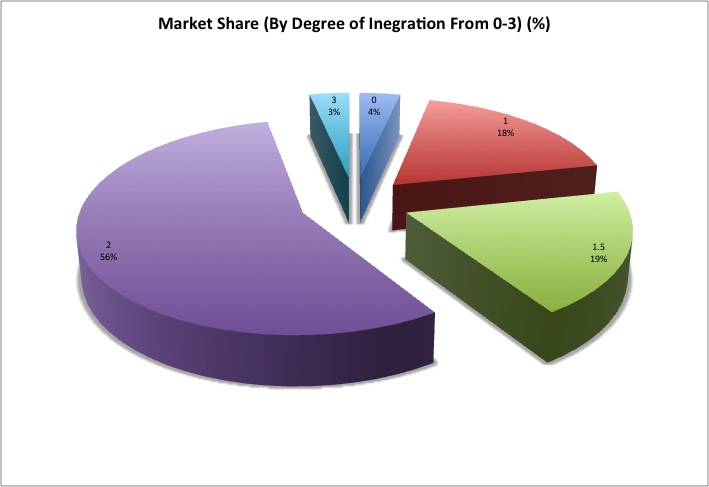

Then we took automobile industry (electric automobile industry) as the downstream firms of our research and found the market share of those automobile manufacturers. We then researched the relationship between those electric car manufacturers and lithium-ion battery providers and classified their relationships according to closeness of their corporation from the degree 0 to 3. “3” represents the greatest level of integration, usually the relationship between a mother firm and its subsidiary and “0” represents basically no close relationship between up and downstream firms. We discovered that in the downstream market, the firms which have at least some kind of vertical integration (degree range from 1.5-3) for example, joint venture and some research agreement takes up 78% of the market share which shows the advantage of such high vertical integration and affirms our hypothesis. We also looked through small electronic markets such as cellphone market, laptop market, and tablet market, which also use lithium-ion batteries and got the same result.

Improvement that should be Made and Afterwards: all the hypothesis and corollary we got above requires too many assumptions that are shouldn’t be ruled out in the real world. We have tried to eliminate them through more careful research on price, unit cost, research and development costs of those upstream firms and hoped to fit them in the model that professor Turkay constructed. However, we were not able to do so because most of such information is commercially confidential. We also discovered that, there could be other factors that cause the resulting market share even though we have eliminated many of them. Next step will be to find more factors that will probably affect the outcome of our research and find other ways of searching those data.