I researched with professor Esteban Argudo and Ningyao Geng about the tax repatriation holiday which is part of the Tax Cuts and Jobs Act of 2017 (TCJA) enacted by President Trump on December 22, 2017. Our main research questions were the following:

■ Looking at differences in Multinational Corporations and Domestic Firms

■ Does the introduction of the Tax Repatriation Act affect the behavior of firms? If so, how?

■ Looking at differences in firms that will repatriate and those that won’t

■ Assess if the proposed one-time tax repatriation of the TCJA reform will lead or not to higher investment, output, wages, and employment

■ Look at how firms use repatriated foreign earnings

However, due to limitations and challenges to data collection, we mainly focused on the first two research questions. We used the CSV and TSV files uploaded at the U.S. Securities and Exchange Commission (SEC) site. The final dataset we got had 10148 unique firms, 45604 rows and 30+ columns (variables).

Previous Literature that performed research on the repatriation tax holiday from U.S. The American Jobs Creation Act of 2004 (AJCA) generally concludes that repatriation had little to no effect on domestic investment, employment, and R&D. Instead, repatriated foreign profits were used to buy back shares and increase the dividends given to their shareholders.

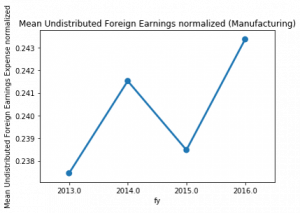

To keep the firms for analysis constant, we kept only the firms that had values for all fiscal years 2013 to 2016 (Because our data for those years matched well with BEA data) and focused on the manufacturing industry which had the most data points.

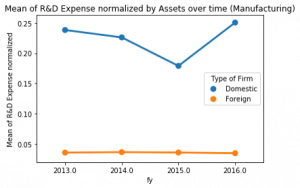

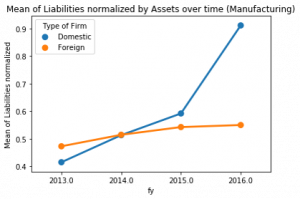

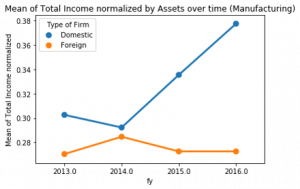

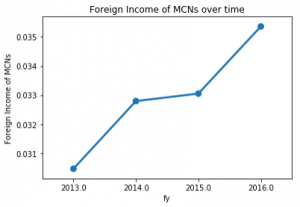

The following are some findings from exploratory data analysis:

■ Decrease in UFE doesn’t correspond to higher R&D for both domestic firms and MNCs which supports findings from previous literature

■ R&D for MNCs seems to be pretty stable between 3.5%-3.6% level of assets. Repatriation of funds doesn’t really seem to affect R&D behavior of MNCs

■ For both domestic firms and MNCs, liabilities are increasing over time. Liabilities keep increasing regardless of repatriation, so repatriation doesn’t seem to affect liabilities

■ Has the introduction or announcement of the repatriation tax holiday incentive firms to stockpile money overseas? (Hence, the increase in UFE in that period)

■ But increase in foreign income in that period would have also contributed to the increase in UFE.