Nadim Majumder ’21, Economics & Computer Science

Professor Esteban Argudo, Economics Department

This summer, I worked with Professor Argudo and Sarra Yekta ‘21 on the topic of using peer-to-peer lending data to study monetary policy transmission. The main questions we sought to answer were:

- What effect does monetary policy surprises have on loans?

- How are interest rates decided? What are the most relevant factors in its calculation?

- Is it possible to gain an estimation for both the marginal propensity to lend (MPL) and borrow (MPB)?

The dataset we used was sourced from Lending Club, a peer-to-peer lending platform for small loans (<$40,000). Lending Club is atypical among loan-issuing institutions in that it does not directly fund the loans, instead it posts the requests on its site, where investors (individuals, not corporations) can decide to either partially or fully fund the loan. The dataset we collected was very rich, containing over 2.2 million observations (loans) with 147 variables (FICO scores, annual income, debt-to-income ratio) listed for each. However, crucially they were missing the origination dates for each of these loans.

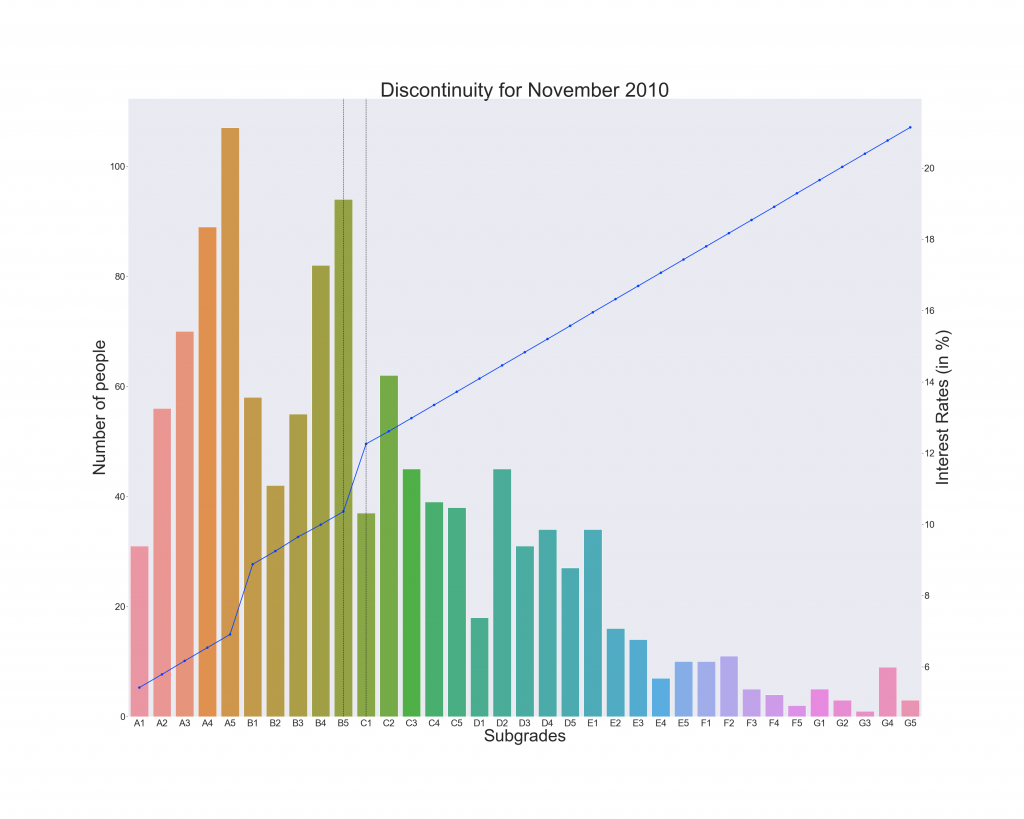

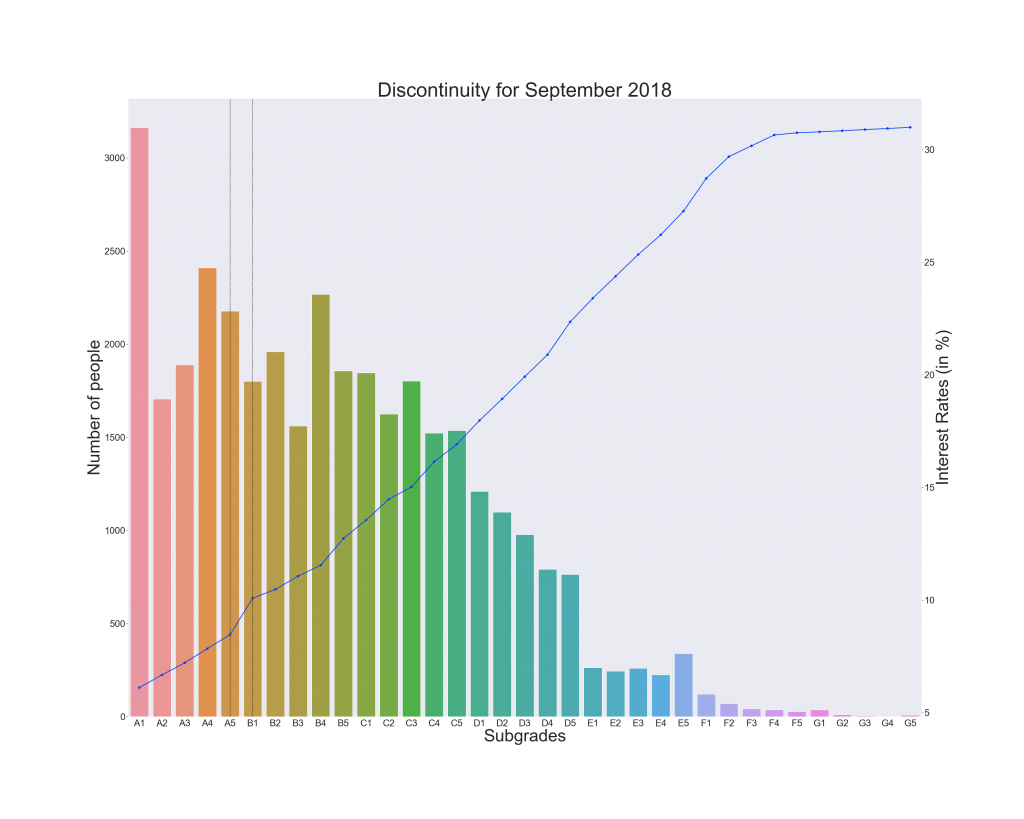

I began the project by scraping the individual loan listings on the Lending Club website to retrieve the origination dates which would be crucial in answering our first question. From that point forward however, I focused primarily on the second and third questions, allowing my co-worker Sarra to tackle the first. In exploring the data, I discovered that, in 66% of cases, the interest rates for the loans mapped one-to-one to a unique combination of the loan issuance date (MM-YYYY format) and loan grade (ranging from A to G, in increasing order of default likelihood). I then made use of a regression discontinuity design (RDD) to further explore this relationship. In essence, the RDD attempts to identify two groups, one with a treatment effect applied after a certain cutoff point, the other without. By examining the individuals around the cutoff point, it would be possible to determine how similar they are to one another, and so identify reasons for the discontinuity in the interest rates e.g. if two such individuals are the same across all variables except their annual incomes, and they have differing interest rates, then that points to the annual income being the determining factor. I managed to identify 122 such discontinuities through visual inspection, a few pictured below.

Unfortunately, we then realized that due to the nature of the loan grades (in that they are discrete values), all of the points above technically qualified as discontinuities. As a result, we decided to pivot, instead grouping individuals based on their interest rates, and then making comparisons between these groups. Remarkably, we found that they were similar in most respects – annual income, debt-to-income ratio, revolving utilization when the loan amounts were similar. We were also able to calculate values for the marginal propensity to lend for some of these groups (the change in loan amount given a change in the interest rate). However, about 42.7% of these were negative meaning that they are likely a grouping of both the marginal propensity to lend and borrow.

Further work on this project would possibly involve isolating the MPL and MPB and further investigating the interest rate groupings.