I worked with Professor Mampilly in the Political Science Department to understand the noneconomic logics of rebel taxation, in preparation for abook Professor Mampilly is writing.

The traditional view of rebel taxation is as a revenue generation scheme. These Olsonian logics, which focus on self interested group behavior, do not capture all benefits of taxation. It is also not entirely clear that taxation practices generate a useful amount of money.

I spent a fair portion of the project delving into concepts of moral economy. Moral economic analysis places an emphasis on relationships, morality, and social norms rather than utility maximization. This lens was very useful for how Professor Mampilly and I began to think about why rebels use taxation.

Logics of social norms suggest that taxation can be used as a mechanism for legitimizing a group as a government. It also provides a more nuanced understanding of what people expect from a ruling body.

This research led to interesting ways in which economists are applying the ideas of moral economy, shedding light on how it is possible to properly quantify and analyze data Professor Mampilly has on rebel taxation practices. Examples of such work have found ways to quantify how much a person values public perception of their actions, as well as track how charitable contribution decisions are made in rural versus urban environments. It was very interesting to do research outside of my primary area of study, where I got to apply my skill set in a different way.

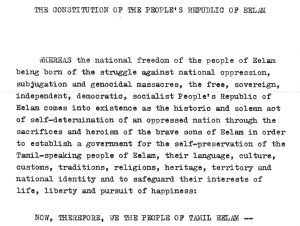

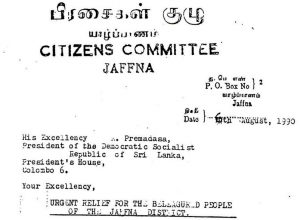

I also investigated an archive of documents surrounding the Tamil Tigers. Gathering primary sources on a rebel conflict to understand taxation and monetary practices was a valuable and informative experience.